michigan use tax registration

This process is easy fast secure and convenient. A sales tax license can be obtained by registering the E-Registration for Michigan T a xes or submitting Form 518.

How To Register For A Sales Tax Permit In Michigan Taxvalet

Relax By Choosing Electronic Filing For Faster Processing Of Your IRS Form 2290 With Us.

. Account Numbers Needed. Relax By Choosing Electronic Filing For Faster Processing Of Your IRS Form 2290 With Us. Michigan Business Tax 2019 MBT Forms 2020 MBT Forms.

Keller Is an IRS Approved e-File Provider. Simplify the sales tax registration process with help from Avalara. Obtain a Duplicate Michigan Vehicle.

After completing the online application you will receive a. A Michigan Tax Registration can only be obtained through an authorized government agency. Minimum 6 maximum 15000 per.

Welcome to Michigan Treasury Online MTO. Complete Treasurys registration application. Treasury is committed to protecting sensitive taxpayer.

If the business has a federal Employer Identification Number EIN the EIN will also be the Treasury business account number. The Michigan Department of Treasury offers an Online New Business Registration process. Michigan Sales Use Tax Reference.

If you elect to pay use tax on receipts from the rental or lease you must first obtain a Use Tax Registration before you acquire the property. Notice of New Sales Tax Requirements for Out-of-State Sellers. Ad Fill out one form choose your states let Avalara take care of sales tax registration.

Simplify the sales tax registration process with help from Avalara. The e-Registration process is much faster than registering by mail. Keller Is an IRS Approved e-File Provider.

Sales Use Tax Licensure. For more information visit the MTO Help Center. As of March 2019 the Michigan Department of Treasury offers.

Ad Fill Sign Email MI DoT 518 More Fillable Forms Register and Subscribe Now. For transactions occurring on and after October 1 2015 an out-of-state seller may be. E-Register via Michigan Treasury Online.

Streamlined Sales and Use Tax Project. MTO is the Michigan Department of Treasurys web portal to many business taxes. 20526 - Use tax registration.

The state of Michigan sales tax is 6. For employers who pay employees in Michigan use this guide to learn whats required to start running payroll while keeping compliant with state payroll tax regulations. Vehicle registration late fee.

In the state of. This is a use tax registration. This section applies to businesses that are applying for a license in Michigan for the first time.

Vehicle registration transfer fee. 1 Sales of new and used automobiles buses trucks tractors trailers housetrailers motorcycles motor. Ad File Your IRS 2290 Form Online.

Vehicle title late fee. Companies who pay employees in Michigan must register with the MI Department of Treasury for a Withholding Account Number and the MI. Michigans use tax rate is six percent.

20554 - Automobile and other vehicle dealers. An on-time discount of 05 percent on the first 4 percent of the tax. E-Registration applications are processed within 5-10 minutes of.

This registration will also allow a business to. This e-Registration process is much faster than. A sellers permit is commonly known as a sales tax permit reseller permit resale certificate sales tax exemption certificate sales tax license or sales and use tax permit.

Ad File Your IRS 2290 Form Online. This tax will be remitted to the state on monthly quarterly or annual returns as required by the Department. 1 Activities that require a registration under the use tax act include but are not limited to all of the following.

Use tax on tangible personal property is. To Register for Withholding Tax. Michigan Department of Treasury.

Within the states borders there are about 337 local tax jurisdictions. Ad Fill out one form choose your states let Avalara take care of sales tax registration. Local governments have No latitude to collect an optional local tax.

How To Register For A Sales Tax Permit In Michigan Taxvalet

20 Hotel Business Plan Template Simple Template Design

Michigan Sales Tax Handbook 2022

14th Annual Vaikasi Visakam For Lord Muruga Parashakthi Temple Temple Lord Religious Event

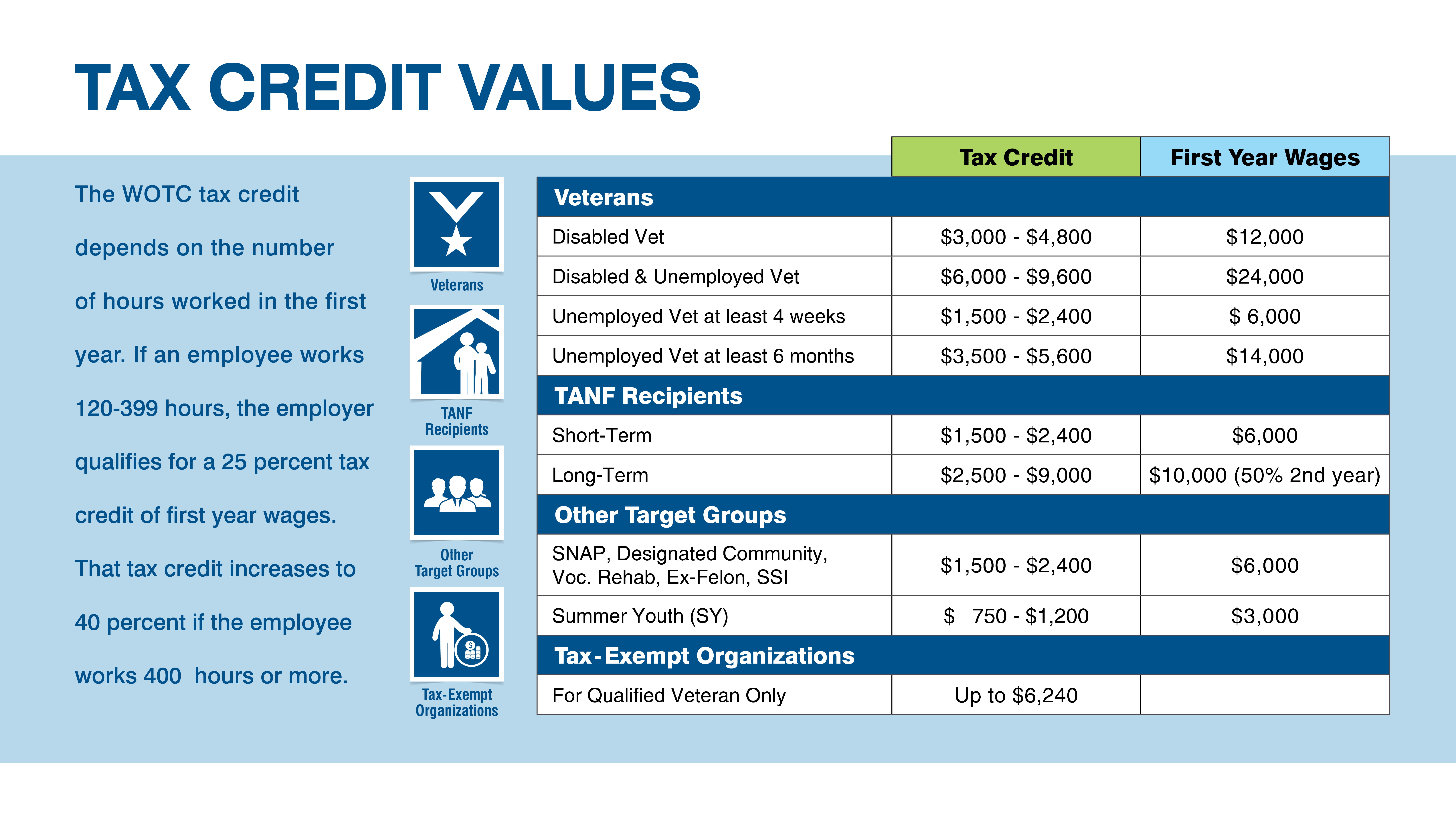

Leo Work Opportunity Tax Credit

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Michigan Sales Tax Small Business Guide Truic

Free Michigan 7 Day Notice To Quit Form Pdf Word Do It Yourself Forms

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Individuals Use The Option Of Filing An Amendedtaxreturn When He Or She Comes To Know That There Is An Error In His Al Income Tax Tax Consulting Tax Extension